1. be borne by New Zealand sheep farmers if it is imposed on sales of New Zealand wool.

2. be borne by New Zealand sheep farmers if it is imposed on sales of wool to New Zealand consumers.

3. be borne by sheep farmers and consumers in the same way regardless who the tax is imposed on.

4. be borne by sheep farmers and consumers in a way that cannot be determined on the basis of the information given.

Choose the option that yields the correct answer.

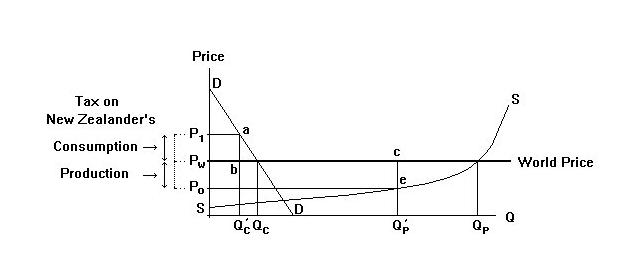

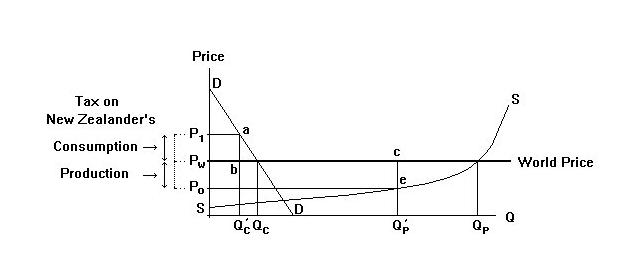

The correct answer is option 1. All New Zealand wool is sold at the world price---the demand for New Zealand wool is thus perfectly elastic. The price received by New Zealand sheep farmers is therefore less than the world price by the amount of the tax and the entire tax burden falls on producer rent. New Zealand consumers can buy all the wool they want at the world price, so the net-of-tax price they pay is independent of any tax on New Zealand wool. If the tax is on purchases of wool by New Zealand consumers rather than on New Zealand wool, it will be borne entirely by those consumers. New Zealand sheep farmers will continue to sell at the world price regardless of that tax and regardless of who they sell their wool to. The situation is illustrated in the Figure below.

A tax imposed on New Zealand wool (that is, wool from New Zealand sheep) is a tax on New Zealand wool production whether the tax is in the first instance paid by the buyer of the wool or by the seller. Since the wool can be sold (or bought) on the world market at the fixed world price Pw, the buyer must pay New Zealand wool producers the world price minus the tax, or P0. This tax will raise an amount of revenue equal to the area Pw c e P0, all of which will come out of producers' rent.

Alternatively, a tax placed on purchases of wool by New Zealand consumers must be added to the world price in obtaining the price that they must pay for wool. New Zealand consumers can buy all the wool they want at the world price Pw plus the per unit tax. This means that they will have to pay the price P1. Note also that it will make no difference whether the tax is paid in the first instance by the actual purchasers of the wool or by the persons who sold it to them. This tax raises the revenue P1 a b Pw, all of which comes out of consumer rent. New Zealand producers, on the other hand can continue to sell their wool at the world price. If they sell it to a New Zealand consumer, that consumer will have to pay P1 for but producers will nevertheless receive the after-tax price Pw.